Key Highlights

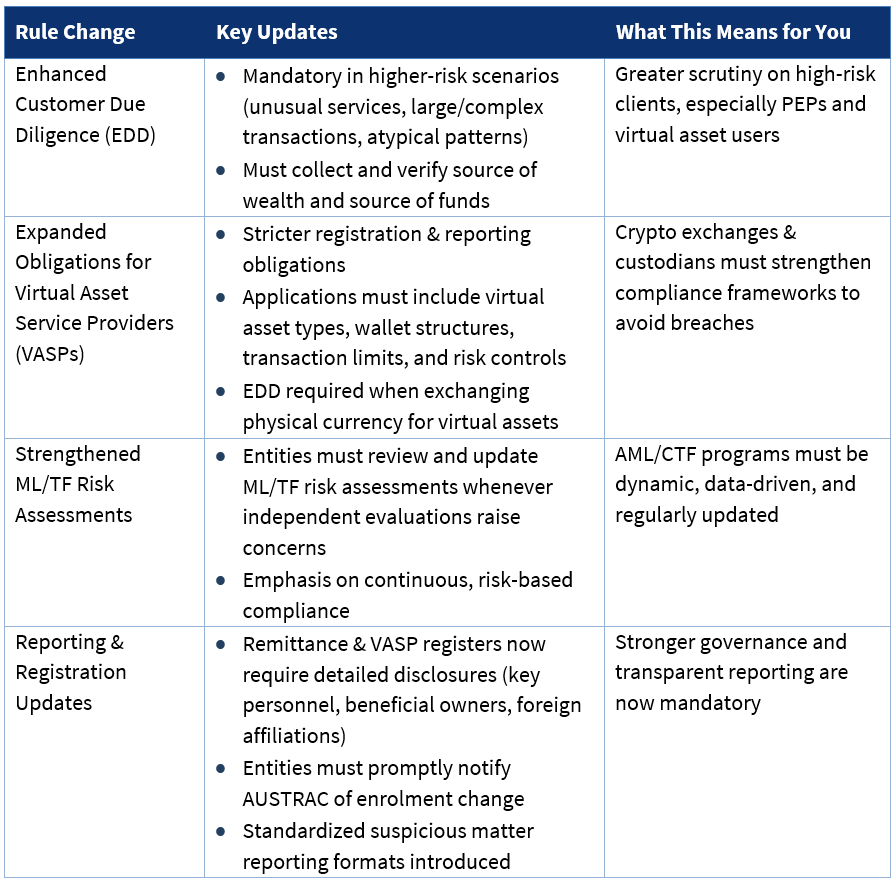

AUSTRAC has released the 2025 Anti-Money Laundering and Counter-Terrorism Financing (AML/CTF) Rules, marking some of the most comprehensive updates in recent years. These changes are designed to bring Australia’s AML/CTF regime in line with global FATF standards, address risks from emerging technologies like virtual assets, and raise the bar for customer due diligence (CDD) and reporting entities.

Scope of Applicability

The rules expand the regulated population principally in two ways:

- Tranche-2 sectors: Certain professional and commercial service providers (examples include lawyers, accountants & auditors, trust & company service providers, real estate agents, and dealers in precious metals & stones). These entities become reporting entities when they provide designated services under the instrument.

- VASPs (registrable services): The instrument defines registrable virtual-asset services (including exchanges, custodial and wallet services, issuance and other value-transfer functions) and sets registration, disclosure and operational information requirements for applicants.

Implications: If your organization touches transfers, custody, remittances, crypto value flows or high-value professional services, these rules change what data you must collect, how you must monitor flows, and how you must demonstrate governance and fitness to AUSTRAC. Expect process, system and documentary changes across onboarding, monitoring and reporting.

Detailed Regulatory Requirements & Implementation

Enhanced Customer Due Diligence (EDD)

Triggers for EDD Include:

- Client involvement in unusual service arrangements outside typical business patterns

- Large or complex transactions per AUSTRAC’s risk-based approach (there is no fixed AUD10,000 threshold for virtual assets)

- Politically Exposed Persons (PEPs) and their family members or close associates

- Cross-border transactions involving high-risk jurisdictions as defined by AUSTRAC’s country risk assessments

Documentation Requirements:

- Verification of source of wealth using documentary evidence (e.g., employment or business records, inheritance documentation)

- Verification of source of funds for the immediate transaction (e.g., bank statements, contracts)

- Enhanced identity verification using multiple independent sources

- Ongoing monitoring documentation conducted on a risk-based schedule proportionate to customer risk

Compliance Challenge: Manual verification typically causes onboarding delays for high-risk clients.

Solytics Partners Solution: Manual verification typically causes onboarding delays for high-risk clients

Virtual Asset Service Providers (VASPs) - Specific Obligations

Registration Requirements Include:

- Disclosure of specific virtual asset types handled (Bitcoin, Ethereum, stablecoins, NFTs, etc.)

- Wallet infrastructure mapping, including hot wallet vs. cold storage, multi-sign requirements, and custody arrangements

- Documentation of transaction risk controls such as monitoring systems, sanctions screening, and suspicious activity detection

Operational Compliance Mandates:

- Real-time sanctions screening against AUSTRAC, OFAC, and UN lists for all virtual asset transactions

- Enhanced due diligence when customers exchange physical currency for virtual assets under designated services

- AI-driven transaction monitoring for structuring, rapid transfers, and mixing service usage

Compliance Challenge: Monitoring wallet-to-wallet transactions across multiple blockchains while balancing privacy and 24/7 operational demands.

Solytics Partners Solution: VASP Compliance Suite combines real-time blockchain analytics, automated wallet-risk scoring, and high-speed sanctions screening to detect and prioritize suspicious activity. It also automatically generates AUSTRAC-aligned compliance reports with full audit trails, simplifying investigations and regulatory filings.

Strengthened ML/TF Risk Assessments - Detailed Requirements

Review Triggers:

- Independent evaluations identifying control gaps or systemic weaknesses

- Regulatory guidance updates from AUSTRAC, FATF, or international partners

- Significant business changes like new product launches or market expansion

- Risk incidents such as suspicious activity surges or system compromises

Documentation Standards:

- Quantitative risk metrics using statistical models across customer segments and geographies

- Scenario testing results to validate system robustness

- Control effectiveness metrics, including detection rates, false positives, and investigation KPIs

- Remediation plans with timelines and responsible parties

Compliance Challenge: Traditional assessments become outdated quickly and require manual, time-consuming updates.

Solytics Partners Solution: The Dynamic Risk Assessment tool continuously ingests transaction data and regulatory updates to automatically recalibrate risk scores and trigger reassessments when necessary. It also feeds executive dashboards that give real-time visibility into compliance posture and investigation priorities.

Reporting & Registration Updates - Specific Disclosure Requirements

- Disclosure of key personnel backgrounds including compliance officers, executives, and beneficial owners (criminal history checks)

- Corporate structure mapping detailing subsidiaries, affiliates, and ownership

- Foreign relationship documentation covering correspondent banking and cross-border partnerships

- Technology infrastructure details, including core banking and compliance platforms

- Notification mandates to AUSTRAC for key changes as soon as practicable

- Program updates to be completed within 14 days of change

- Annual attestations by senior executives on AML/CTF compliance

- Suspicious matter reporting with standardized fields to support automation (excludes initial "investigation outcomes")

Compliance Challenge: Traditional assessments become outdated quickly and require manual, time-consuming updates.

Solytics Partners Solution: The Dynamic Risk Assessment tool continuously ingests transaction data and regulatory updates to automatically recalibrate risk scores and trigger reassessments when necessary. It also feeds executive dashboards that give real-time visibility into compliance posture and investigation priorities.

Updated Guidelines and Implications for Regulated Entities

How Solytics Partners Can Help?

At Solytics Partners, we understand that these changes increase the operational and regulatory pressure on compliance teams. Our end-to-end AML solutions are built to help financial institutions stay ahead of the curve.

- Advanced Screening & Monitoring: Real-time name, transaction, and adverse media screening aligned with AUSTRAC’s evolving standards.

- CDD & EDD Automation: Collect, verify, and monitor KYC data, including source of wealth/funds, with minimal manual effort.

- VASP Compliance Tools: Purpose-built workflows for wallet monitoring, risk tiering, and suspicious activity reporting in crypto ecosystems.

- Dynamic Risk Assessments: RA Vault continuously refreshes ML/TF risk profiles using live transaction data, regulatory triggers, and independent evaluations to keep risk prioritization current.

- Regulator-Ready Reporting: Automated documentation and audit trails for compliance with AUSTRAC, FATF, and global standards.

Our ecosystem approach ensures compliance becomes a strategic advantage, allowing you to scale confidently while meeting AUSTRAC’s heightened expectations.

Final Thoughts

The 2025 AUSTRAC AML/CTF rule changes reflect a clear message: compliance must be proactive, data-driven, and future-ready. Institutions that adopt technology-enabled governance will not only meet regulatory demands but also build stronger defenses against financial crime.

To learn how Solytics Partners can strengthen your AML/CTF program, get in touch with us today.

.png)

.png)

_1.png)

_1.png)

.svg)