The Future of Transaction and Fraud Monitoring

Traditional transaction/fraud monitoring platforms can only react to threats after they surface.

EMoT by Solytics Partners is designed to stay one step ahead, leveraging AI-driven analytics, real-time monitoring, and adaptive machine learning models to uncover suspicious activities before they escalate.

Unlike legacy systems, which rely only on static rules and manual oversight, EMoT empowers financial institutions with the tools they need to proactively identify, prioritize, and resolve risks at scale, while enhancing operational efficiency and ensuring compliance accuracy.

Transforming Financial Crime Detection: EMoT by Solytics Partners

Why EMoT?

In a fast-paced financial landscape, legacy transaction monitoring platforms fall short with their reactive approach. Their reliance on outdated methods leads to high false positives, delayed responses, and inefficient workflows.

Moreover, they struggle to detect emerging threat types such as money mules, synthetic identities, and complex fraud rings.

EMoT, however, goes beyond conventional monitoring by offering smarter detection, faster decision-making, and continuous learning.

The platform provides AI-powered threat detection and protection and real-time insights, delivering a proactive, cost-effective, and compliant solution that is built to scale as threats evolve.

Key Features & Differentiators

AI-Powered Detection & Real-Time Analysis

- Unsupervised and supervised machine learning models to identify hidden patterns, emerging threats, and complex fraudulent activities like money mules, and shell companies.

- Real-time transaction monitoring ensures no threat goes unnoticed, with immediate alerts and triaging.

- Dynamic segmentation models that adapt to changing data streams for more granular risk detection across customer segments.

Behavioral Detection and Anomaly Identification

- Behavioral profiling of transaction patterns enables detection of anomalies that traditional rule-based systems cannot capture.

- Advanced anomaly detection models uncover suspicious behavior in real-time, making it easier to flag outliers and mitigate risks before they become incidents.

- Continuous learning from past alerts allows the system to automatically adapt and enhance future monitoring capabilities.

Seamless Integration & Scalability

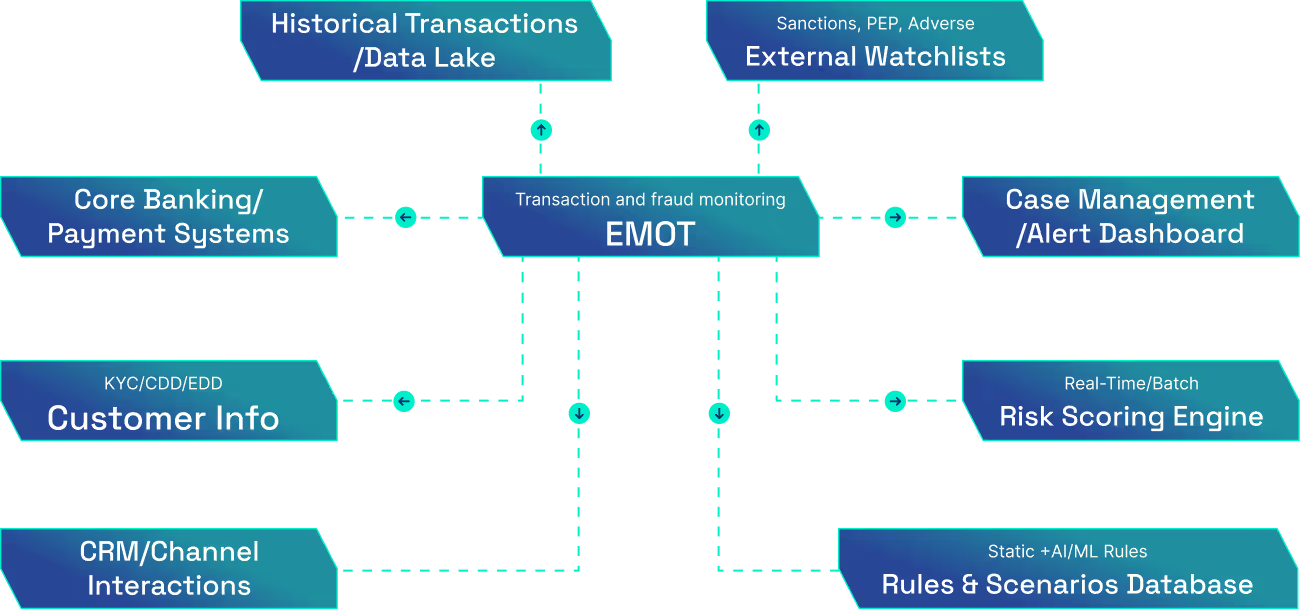

- EMoT integrates effortlessly with core banking systems, payment channels, hubs, and third-party CRMs, ensuring smooth data exchange via pre-built connectors and APIs.

- The platform scales to meet the needs of institutions of all sizes—from local banks to global financial enterprises—without compromising performance.

- Cloud-native architecture ensures high availability, while also supporting hybrid or on-premise deployment based on user preference.

No-Code / Low-Code Scenario Management

- Easily configure and modify red flag scenarios with our no-code/low-code scenario designer—no IT expertise required.

- Adjust or create custom monitoring rules quickly, without the need for technical assistance, to meet the evolving regulatory landscape.

Real-Time Alert Prioritization and Investigation

- AI-driven alert optimization reduces false positives, ensuring compliance teams only focus on the most critical alerts.

- Alerts are enriched with relevant transaction context and AI-powered case summaries to speed up investigation, making it easier for compliance teams to prioritize high-risk cases.

- Integrated case management streamlines the entire investigative process, allowing for faster decision-making and regulatory reporting.

Scenario Repository

- Pre-built scenario repository across multiple domains and industry segments like credit card, TBML, retail banking, fintech, insurance etc.

- Robust rule repository to cover multiple typologies and red flag indicators across different regulatory guidelines.

- Dynamic threshold calibration for the rule-based scenarios based on historical data and productivity.

Benefits of EMoT

Enhanced Risk Detection

Increased Efficiency

Scalability & Flexibility

Faster Incident Response

Comprehensive Audit Trails

Regulatory Confidence

How EMoT Works

Transform your transaction monitoring approach with EMoT. No more silos, no more inefficiencies – just smarter, faster, and more effective compliance.

.svg)

Ready to modernize your transaction & fraud monitoring?

.svg)